Exploit trading opportunities inherent in the market place.

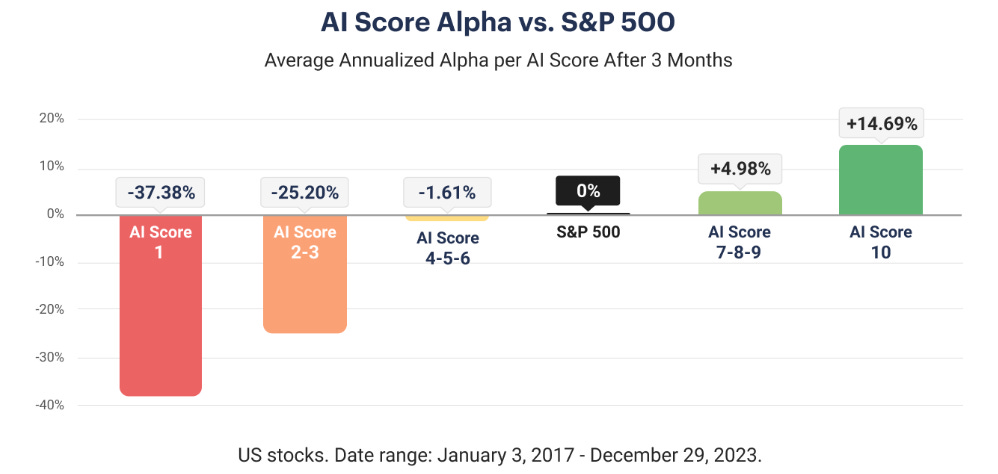

We provide stock analytics, driven by explainable artificial intelligence, that empowers you to take more intelligent risks and understand where to spot opportunities. Our models rate stocks and ETFs with an easy-to-understand AI Score, ranging from 1 to 10:

Stocks with the highest (bullish) AI score (10/10) outperformed the market (S&P 500) by +14.69% on average after 3 months (annualised alpha) in the last 5 years.

Stocks with the lowest (bearish) AI score (1/10) underperformed the market by -37.38% on average (annualised alpha).

Designed for Decision Makers

Who is this for? Hedge fund managers, asset allocators, family offices, individual investors, and those who need leading research on where the market is going. Our research is technical and uniquely personalised for investors.

This is for you if:

Account growth is why you’re here: You’re looking for actionable insights that allow you to express trades in the most appropriate form for your portfolio.

Repeatable processes and frameworks are your thing: Models, frameworks, and exhaustive research are the foundations on which you are looking to build your success.

Modern market insights make you tick: We focus on the analysis so that you focus on what matters most, be it diversifying your portfolio or outright alpha generation.

What you Get

Daily Stock & ETF ranking tables. (Sample)

Daily Trade Idea’s where our AI shows a 60% or above hit rate. (Sample)

Twice weekly Market Briefs.

Weekly broad market Alpha Analysis Reports (50 symbols).

Weekly Thematic Portfolio Alpha Analysis Reports. (Sample Report)

Key Benefits

Performance Maximisation: up-to-date market insights coupled with extensive analysis of over 10,000 features per stock.

Risk Mitigation: Statistically proven forecasting abilities have an edge in predicting market trends.

Informed Decision Making: Simplified actionable insights that allow for data-driven decisions.

It’s like having an investment strategist and analyst in your corner, helping you stay on top of markets — pointing out critical risks and opportunities so you can save time and get ahead in your investment goals.

What next?

If this sounds like what you’ve been looking for, the best thing is to get an annual subscription as it works out to be the cheapest.

If in doubt, think about this: it’s better to have access to a service like this and maybe not end up using each and every single snippet than to not have access — and end up missing a major risk or opportunity.

Ultimately the quality is there, the insights are solid, and we’ve proven our value over and over, so at this point there’s only one thing left to do…

For more information on our methodology, click here , alternatively send us an email at aaj.tgt@protonmail.com.